WHAT THE RECENTLY RELEASED 2025 Q2 DATA DUMP SAYS ABOUT CHINA’S ECONOMY AND PROSPECTS FOR REBALANCING IT:

On July 15th China’s National Bureau of Statistics (NBS) released a raft of new data on the performance of its economy during the 2nd quarter (Q2) of this year. Unlike other recent Chinese economic data dumps, this one was not totally dismal. In particular, the economy grew at a faster than expected pace during Q2. But even this bit of good news needs to be substantially qualified. At the same time, other data points—retail sales, consumer spending, and housing—are indicative of ongoing fragility in the world’s 2nd largest economy and the difficulty of rebalancing it toward greater consumption.

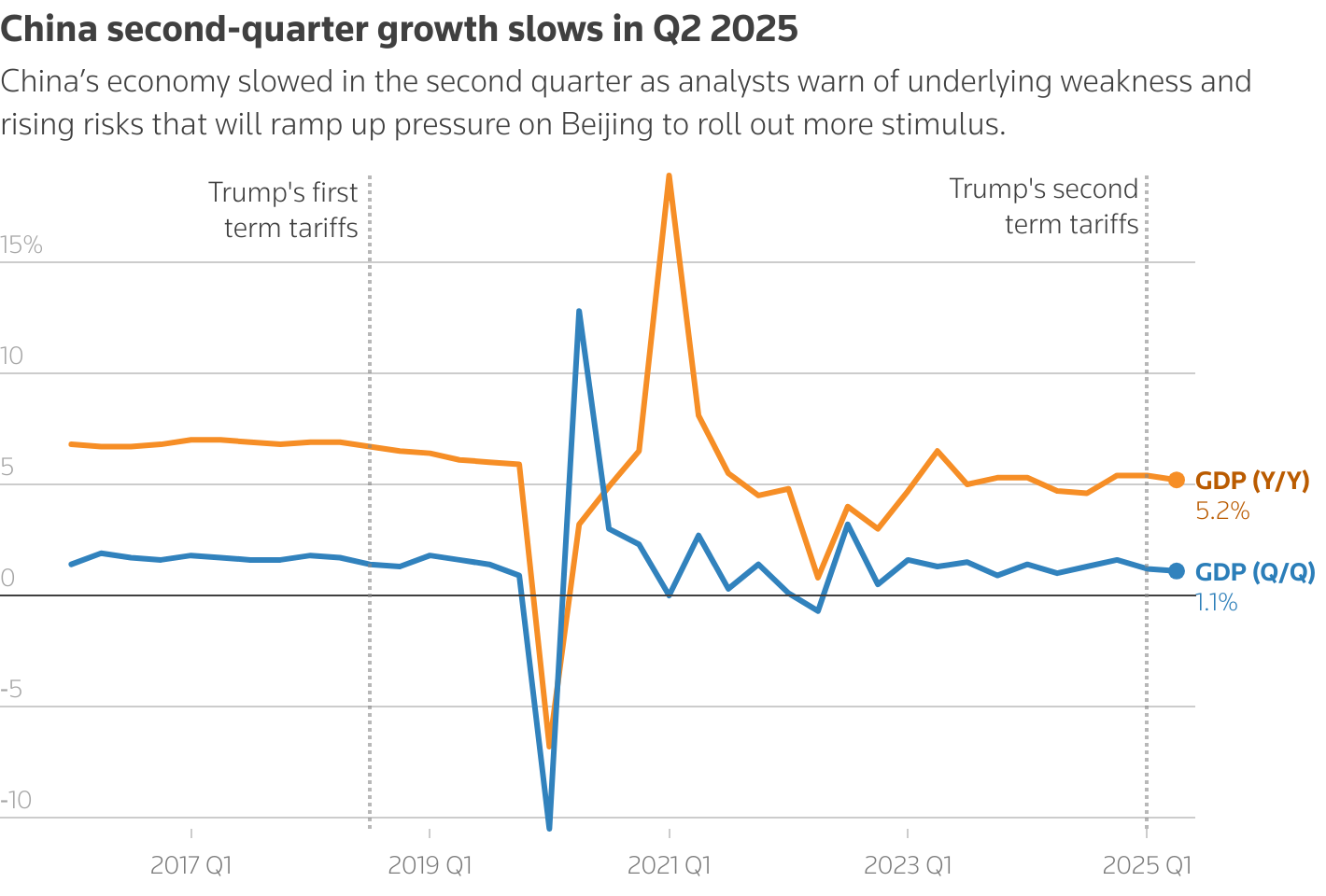

First, one bit of good economic news. China’s Gross Domestic Product (GDP) grew 5.2% during Q2, beating, albeit barely, the 5.1% rise predicted by a Reuters poll of economists. However, lest anyone get too carried away by this, the Q2 growth figure came in below that for the Q1,[1] when the GDP expanded 5.4%, pointing to a deceleration in economic expansion.

Another indicator of this slowdown is a number that came in below analysts’ expectation, fixed asset investment.[2] That rose 2.8% year-on-year in the first half of this year, well below the market forecast of a 3.7% growth rate. On a monthly basis, fixed asset investment decreased by 0.1%. Finally, due to its especially sensitive political nature, official Chinese Government GDP growth figures should be taken with an enormous grain of salt; ditto, it might be added, for the unemployment data. The Rhodium Group estimates that the Chinese GDP actually rose between 2.4 and 2.8% in 2024,[3] well below the official NBS figure of 5%. The latter figure, it could be added, almost exactly matched the economic growth target set by Beijing for 2024.

While fixed asset investment failed to meet the expectations of forecasters, industrial production did the opposite, jumping 6.8% in June vs. the predicted growth rate of 5.7%. The June rise was 1% above the 5.8% increase in May, which marked a six-month low, and was the fastest expansion since March. This latest uptick[4] as largely supported by Beijing’s recent stimulus measures, notably the rebate program it has offered to consumers to replace older durable goods with new ones (more on that below).

The rise in manufacturing output might be seen as unalloyed good news were it not for the latest June data on retail sales.[5] Retail sales growth in June slowed to 4.8% year-on-year vs. the 6.4% rise year-on-year in May. The June expansion was below the 5.4% rise forecasted in a Reuters poll of economists. In particular, catering sales, including food and beverages, crept up by just 0.9%, the worst performance since December 2022, when China began recovering from the Covid Pandemic lockdowns. When set against the sharp boost in industrial production, the June retail sales data points to a widening gap between China’s manufacturing output and the ability of its households to consume it.

It bears emphasizing that the May uptick in retail may well be a blip on the screen. Over the past few months, government authorities have sought to stimulate consumer demand through a rebate scheme aimed at incentivizing households to trade in old durable goods to purchase new ones. However, it is unclear if this program can go on much longer[6]—last month, for example, the self-governing municipality of Chongqing, home to 30 million people, announced a pause on the program, citing its rising costs.

The problems China is now having in sustaining retail sales reflects ongoing weak consumer sentiment. This lack of optimism is underscored in the latest quarterly surveys of Chinese households[7] conducted by the People’s Bank of China (PBoC). In the PBoC survey for the final quarter of 2024, which was released in March, 61.4% of respondents said they preferred to save, rather than spend money (or invest it). That figure is only slightly below the record high of 64% of households who expressed that preference during the third quarter of last year. Of those who said they would spend more, education, health care, and tourism topped other consumption categories, including durable and non-durable goods.

Ordinary Chinese can hardly be blamed for being reluctant to open their wallets and spend freely on consumer goods and services. Employees are now facing major salary cuts, creating considerable financial uncertainty for households. The pressure on wages has been especially acute for individuals working in state organizations,[8] including those employed in state-owned commercial enterprises, particularly banking and investment concerns, and public servants in provincial and local governments (historically being a civil servant in China has been a ticket to an “iron rice bowl”). Those employed in private companies are also facing wage cuts,[9] as these firms see their profits being squeezed savage price competition and Trump’s trade war. In a further sign of a softening labor market and resulting wage squeeze, the large online recruitment platform, Zhaopin, earlier this year quietly stopped providing compensation data,[10] something it had been doing for at least a decade.

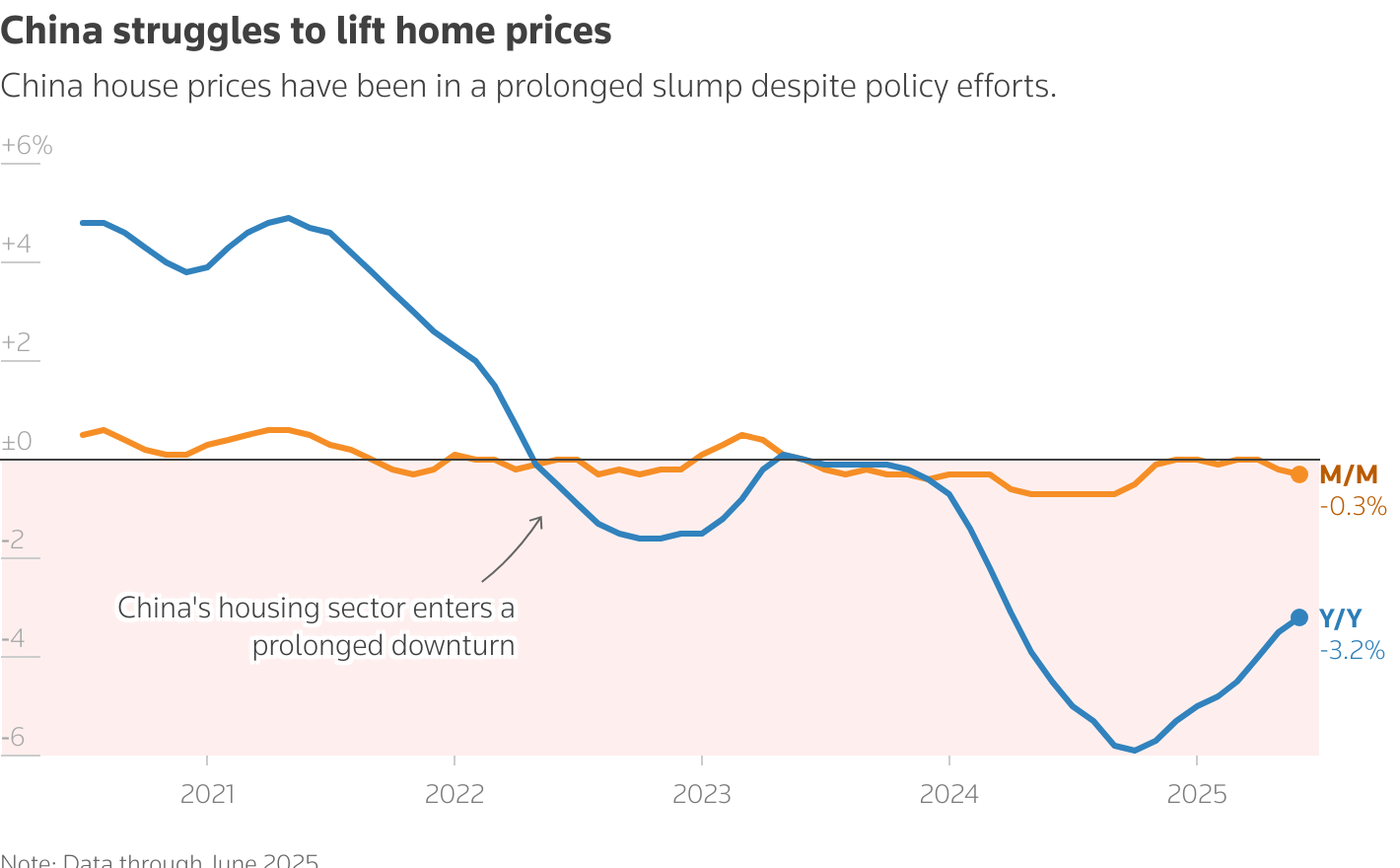

Consumer sentiment is being further dampened by the continuing slump in real estate. With 70% of the wealth of Chinese households in property,[11] the fall in housing prices has made ordinary people feel poorer and more reluctant to spend money. The latest numbers on housing are especially bad, making it clear that an end to the residential property crisis is nowhere in sight.

According to Reuters’ calculations[12] based on NBS released statistics, prices for new homes fell at the fastest monthly pace in eight months in June. The month-on-month drop in new prices amounted to 0.3%, exceeding the 0.2 month-on-month fall in May and extending the downward trend that began in May 2023. During the first six months of 2025, sales by floor area declined 3.5% over the same period last year.

A July 14th Bloomberg review[13] of the latest NBS housing data calculates that new home prices in 70 cities, including state-subsidized housing, decreased 0.27% from May. This also marked the biggest fall in eight months (since September). The price of second-hand homes tumbled 0.61%, also the sharpest drop in eight months. The Bloomberg review contains two other striking data points. One is the value of new home sales from the 100 largest Chinese property companies, which plunged 23% in June compared to the previous year, according to calculations based on China Real Estate Information Corporation data. The other data point concerns home values in China’s 4 Tier 1 cities—Beijing, Shanghai, Guangzhou, and Shenzhen—which have been less affected by the real estate meltdown. In fact, home prices in upper tier metropolises[14] had rising by 0.1% for five straight months before falling 0.2% in May. According to Bloomberg, new home prices last month dipped another 0.1% in the four Tier 1 cities.

The ongoing downturn in real is further underscored by recently released investment figures for this sector. The Reuters’ review of the latest housing numbers notes that NBS data released on July 8th indicates that property investment slumped 11.2% year-on-year in the first six months of 2025. New housing construction starts plummeted 20% in the first half of 2025 compared to the same period in 2024. The 11.2% fall in property investment reported for the first half of 2025 exceeds the 10.7% drop[15] that occurred from January-May, prompting Sheng Laiyuan, NBC deputy commissioner to declare, “The real estate market is still in a process of bottoming.”

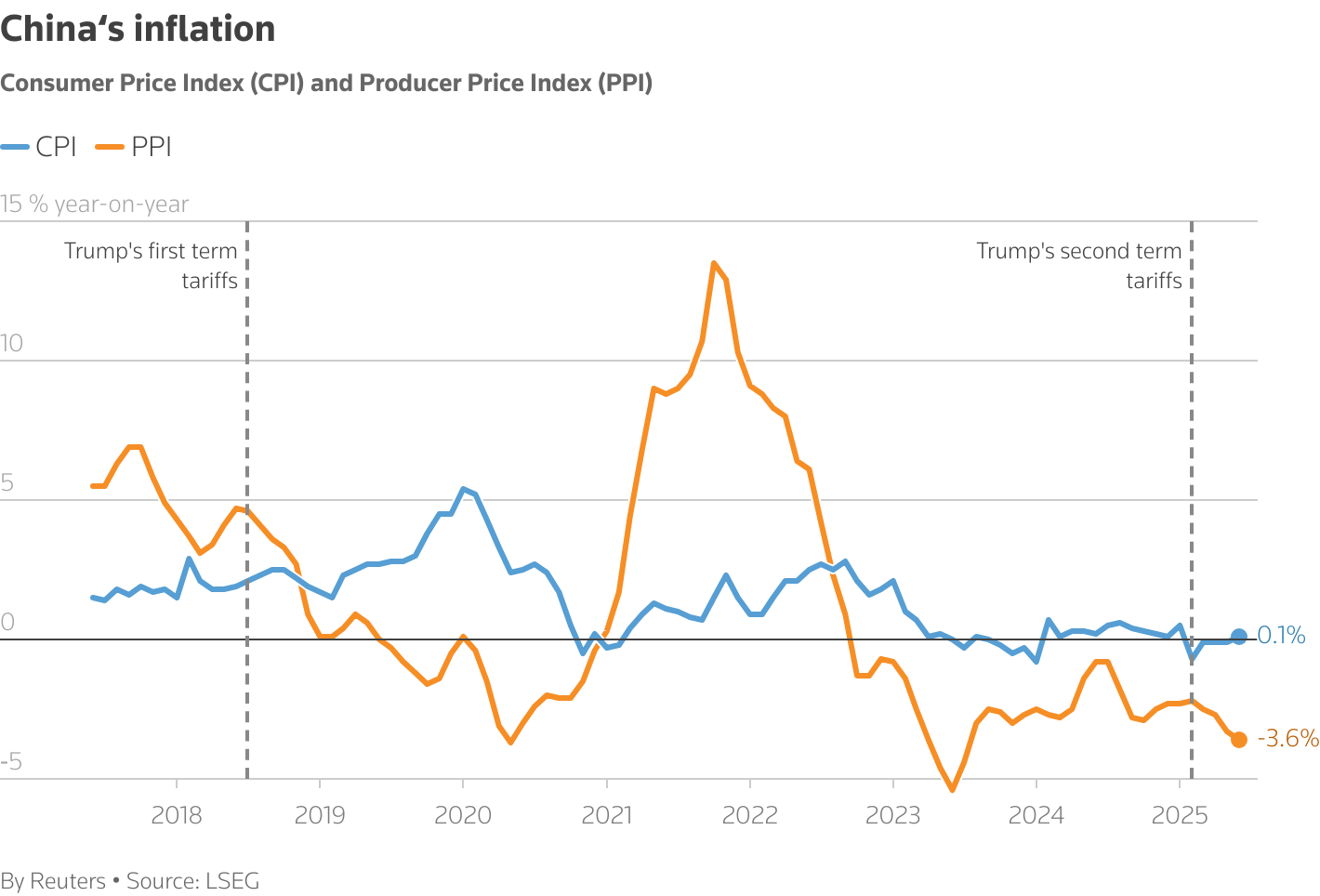

It comes then as no surprise that strong deflationary pressure persists in China’s economy. The June inflation data[16] regarding producer price inflation (PPI) was particularly ugly. The PPI, or factory gate prices, tumbling 3.6% in June from last year. This fall in the PPI was steeper than the 3.3% decline in May and the largest drop since July of 2023. The PPI has now fallen for 33 straight months in a row. The consumer price index (CPI) crept up 0.1%, reversing the 0.1% drop in May. The CPI has flatlined since early 2023.

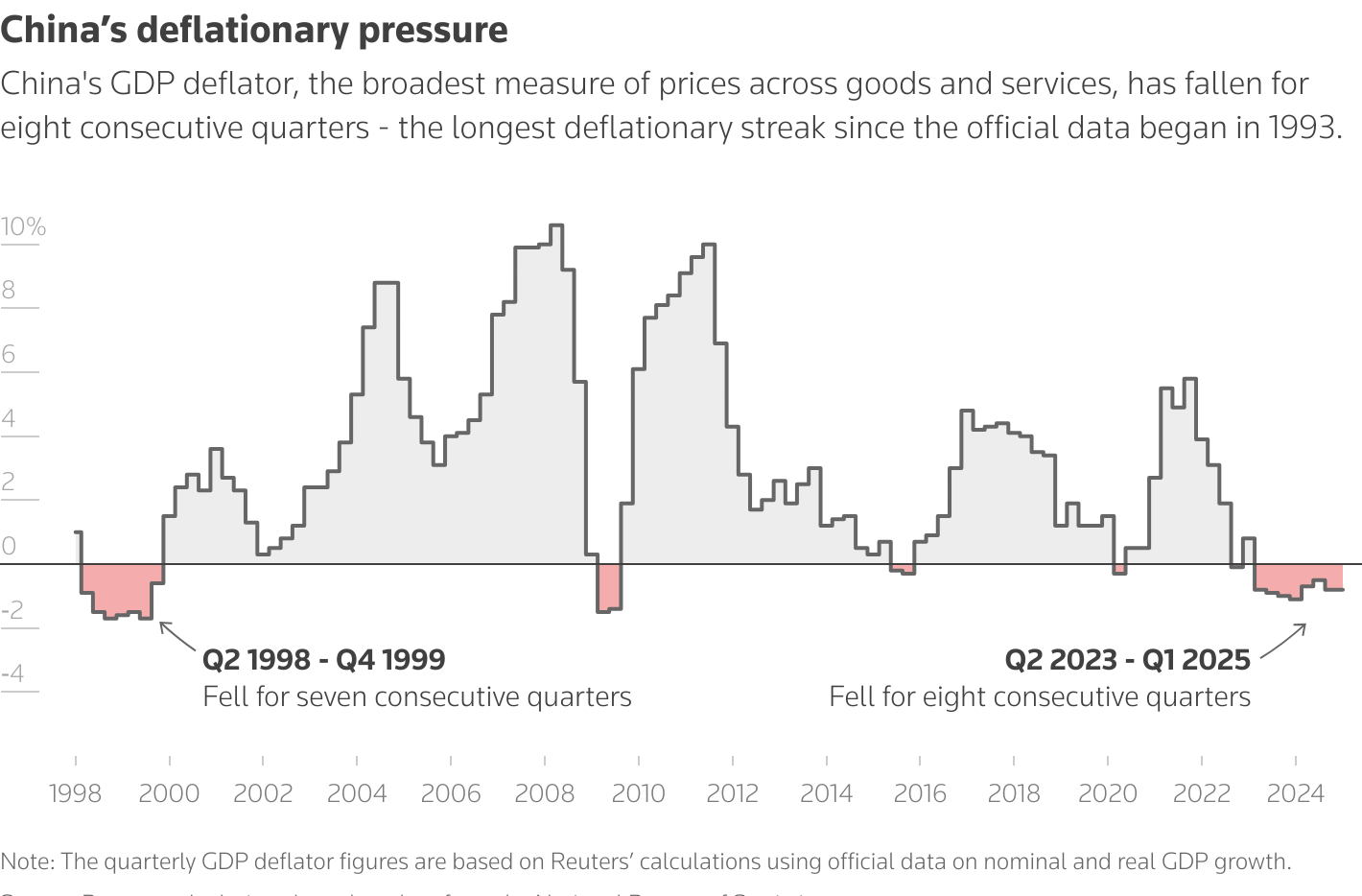

An even stronger indication that the threat of deflation is alive and well in China’s economy is its GDP deflator. The GDP deflator provides the broadest measure of prices across goods and services and is expected to decline further during Q2 in 2025.[17] That would mark the 9th consecutive quarter drop in the deflator, the longest streak since China began collecting such data and exceeds the seven consecutive months of decline that occurred during the 1998 Asian financial crisis.

In a keynote speech[18] delivered at the “Summer Davos” meeting in Tianjin late last month, Premier Li Qiang proclaimed, “We aim to help China transition from a major manufacturing power to a colossal consumer market.” He added at one point, “China’s economy showed steady improvement in the second quarter.” Oh really?! I get that he would engage the spin that top leaders all engage at such events, but has Li even bothered to look at the latest dreadful Chinese economic data?

Ok, after getting in my bit of snarkiness, I will state the obvious, namely that the recent economic data out of China shows that turning the country into a consumer colossus will be a herculean task. Give the top Chinese Government leaders some grudging credit, they are finally recognizing the urgent necessity of rebalancing the economy toward consumption. More importantly, they are taking some first, albeit relatively minor, steps in doing that. On top of the earlier discussed rebate scheme to encourage households to buy more goods, the government is planning this year to provide annual payments of $500 per child under 3 years old[19] to families that have children. This move clearly seeks to both increase consumption and address low birthrates among Chinese women. Zhichun Huang, China Economist at Capital Economics, argues that this program is a “shift in mind-set” of government authorities and opens the way for other measures to support consumption.

The problem facing Beijing is that creating a consumer colossus will require it to do considerably more than just doling out relatively small amounts of cash to households. It will also have to invest massively more in social protection by heavily strengthening the threadbare Chinese social safety net. Doing that, however, will require a huge shift in resources away from current spending priorities.

China’s pension system illustrates the magnitude of this challenge in rebalancing the economy toward consumption. Back in 2019, the Chinese Academy of the Social Sciences concluded that, due to the declining birthrates, the rickety pay-as-you go urban and rural pension schemes would go bust by 2035[20] (the demographic situation for China has arguably worsened since 2019, so that day of reckoning might come even sooner). It bears emphasizing that this future crunch will occur even though benefits for Chinese pensioners[21] are hardly generous—those in cities get an average monthly basic pension of 3,326 RMB, while rural inhabitants receive only 179 RMB per month. I know from personal experience that 3,326 RMB was not enough to get by on in Beijing during my time there from 2006-2016, much less today. China therefore faces enormous unfunded pension liabilities even before it makes any effort to increase benefits for retirees. Yet doing the latter matters for getting households to consume more, as it would reduce the incentive to set aside money to supplement the meager retirement payments now provided by the state.

Bolstering pensions and increasing investment in social protection for health care and unemployment will be a heavy fiscal lift for China. The IMF 2024 China Country Report[22] notes that the ratio of central government debt to GDP is relatively low, at 56.3% in 2024. But factoring in local government debt, particularly that which is off the books and squirreled away in Local Government Finance Vehicles, raises that total government debt to GDP ratio to between 120-130% for 2025. The IMF predicts that this debt to GDP ratio could rise to 200% over the next 15 years absent major fiscal reform, driven mainly by rising pension liabilities associated with China’s rapidly aging population. Citing the continued weakening of China’s public finances, the prominent ratings agency Fitch[23] downgraded its long-term foreign-currency issuer default rating from A+ to A.

To be sure, starting this year, the government will be gradually raising its low retirement ages,[24] which are 60 for men and 55 for women, to reduce the strain on pensions. However, this move will not come anywhere near offsetting the impact of the coming tsunami of retirements on the solvency of China’s pension schemes. Raising the retirement age is also arousing pushback among seniors. The 2024 IMF further recommends that China reduce off-balance investments by local and provincial authorities and institute major tax reform. While the first recommendation is something that should clearly be done, the advice goes against the strong incentive of lower-level official to use off-balance investment to give their local and provincial economies a temporary boost in growth in order to please Beijing. The IMF’s other recommendation is in line with an August 2023 Rhodium Group report,[25] which argues that China’s tax system is based on an investment-led growth model that is now running out of steam. It further notes that altering that system will require levying new taxes, such as taxes on residential property, adding that these measures are sure to encounter resistance from elites within the Communist Party and state.

Even if the Chinese Government is able to create greater fiscal space for itself, the effort to rebalance the economy will involve difficult budgetary tradeoffs. To start with, boosting consumption is not the only big priority the government faces in putting the economy on a more sustainable growth path. One urgent task is cleaning up the huge amount of off-the-books local government debt, estimated to be at $8-11 trillion[26] and address the mess in real estate. Re the latter, even if the creditors of real estate firms that go bust are able to absorb much of the financial losses, someone, namely the government, has to pick the costs of completing the huge number of unfinished projects that were financed out of “pre-sales,” which the Chinese call 烂尾楼 (lànwěilóu), or “rotten tail projects.” Investing in social protection is also sure to compete against the large direct subsidies to targeted industries that are a core element in the China 2025 industrial policy initiative. Last but certainly least, are China’s major and costly defense buildup and expensive Belt and Road Initiative, both of which President Xi has deemed to be key foreign policy priorities. Something will clearly have to give here if China is to become a consumption colossus.

In short, China’s road to rebalancing its economy toward a more sustainable growth model based on consumption will be arduous and require it to make some very hard choices.

ADDENDUM: SLOWER GROWTH FORECAST FOR THE 2ND HALF OF 2025 AND TWO CHARTS VIA REUTERS THAT SAY A LOT ABOUT CHINESE BUSINESSES:

With China’s Q2 GDP expanding slightly faster than analysts had predicted, there has been renewed optimism about its economy meeting the Government growth target of 5% for 2025. That may happen, but the consensus is that the pace of expansion will markedly decelerate during the 2nd half of this year.

According to a Reuters poll of economists,[27] GDP growth is projected to slow to 4.5% during Q3 and to 4.0% during Q4. This pessimism stems from rising headwinds caused by President Trump’s trade war and the challenges Beijing faces in getting households to spend more. Ting Lu, Chief China economist at Nomura Securities notes, “We see a demand cliff in the second half, driven by multiple factors.” Besides the U.S. tariffs, those factors includes the fading impact of the consumer goods trade-in stimulus program and protracted slump in residential property prices.

Bottom line: in 2025, Chinese GDP growth is projected to fall below the 5% government growth target, to 4.6%. It is then predicted to cool down further, growing at 4.2% for next year.

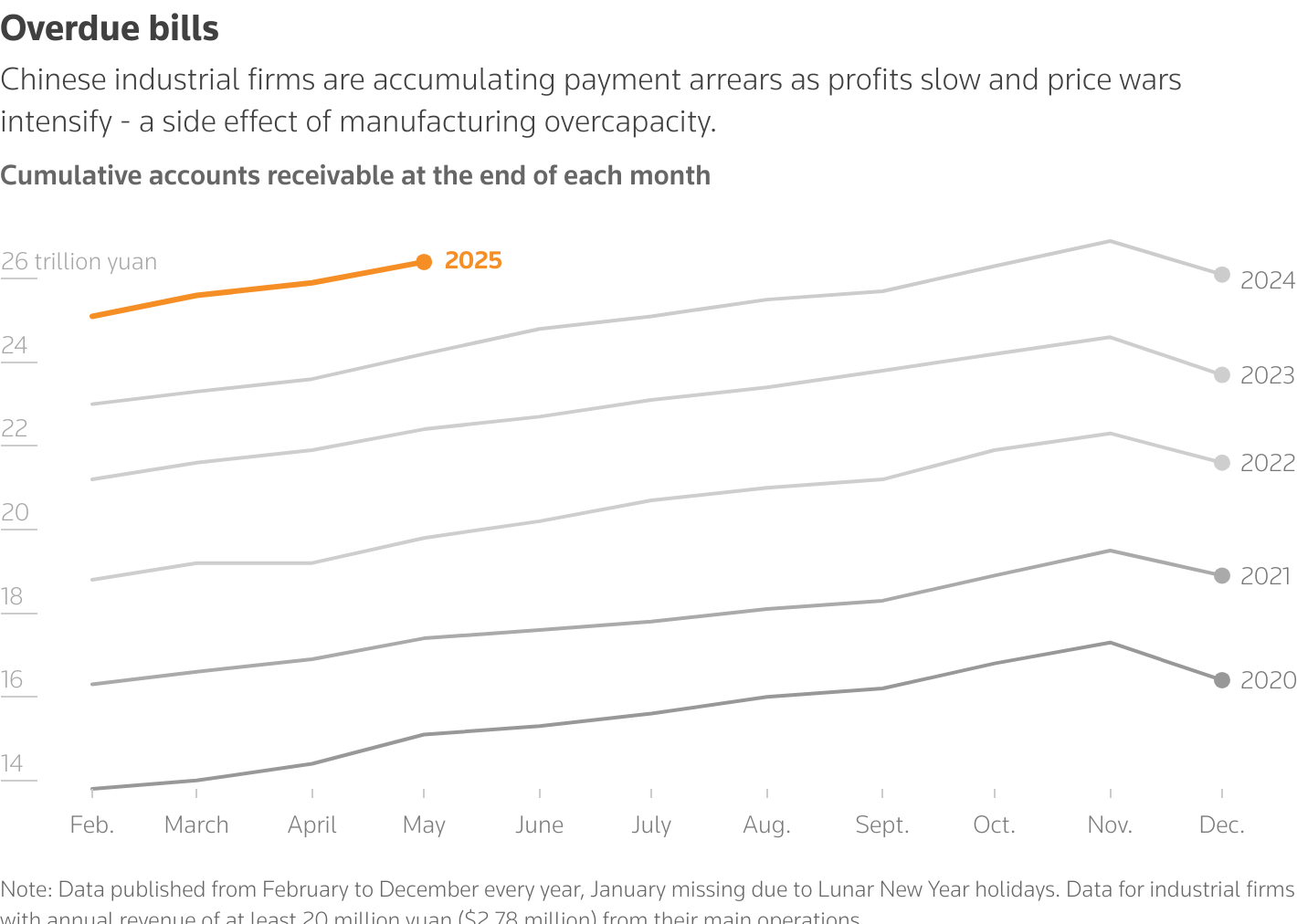

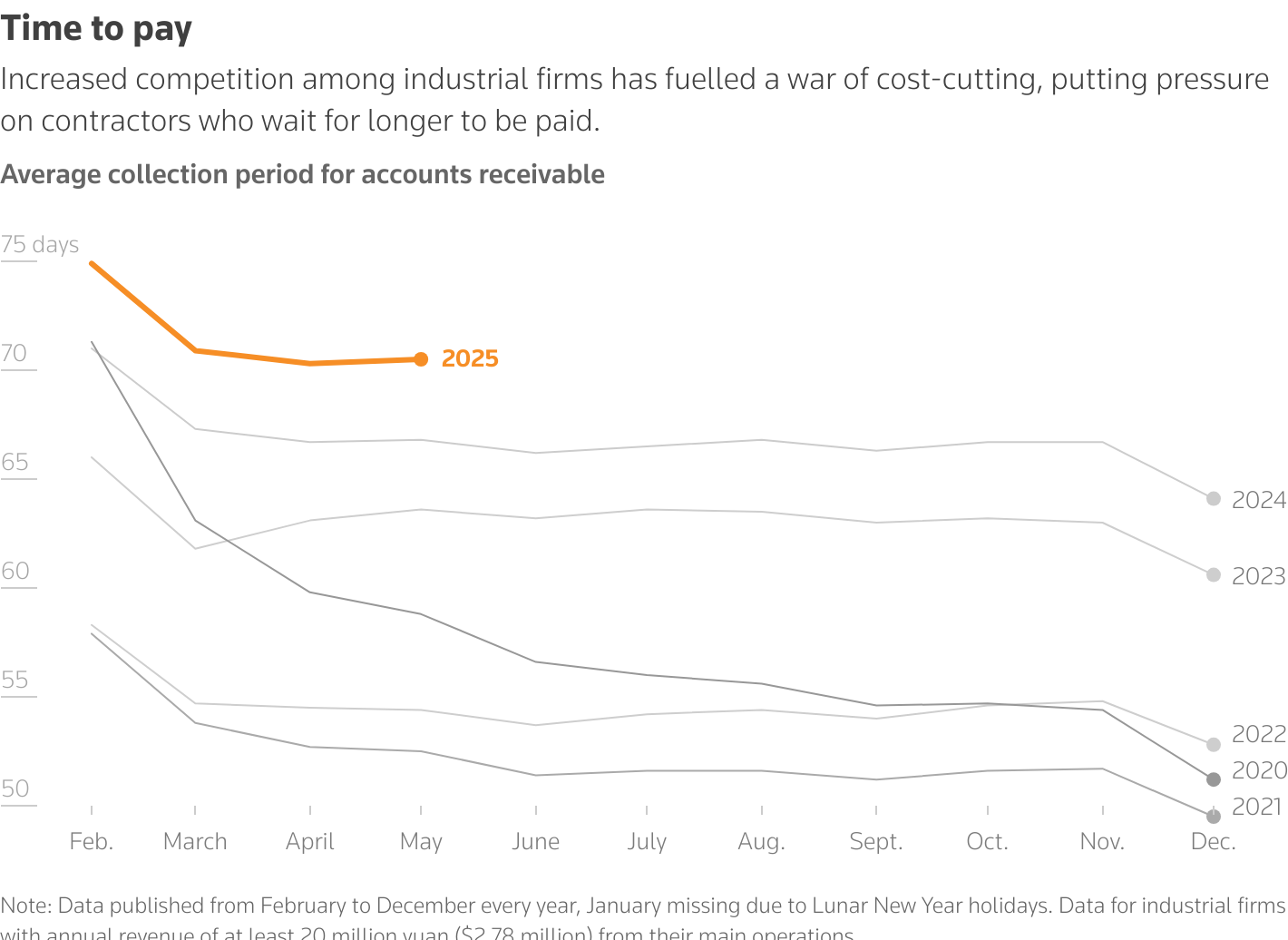

In addition to the glum economic growth forecast for the rest of this year and the upcoming year, Reuters has produced a pair of charts[28] that say a lot about the distressed condition of many Chinese businesses. This is something I discussed in detail in my previous blog post on “zombie” manufacturing enterprises, which now comprise 25% of all such firms.

Here they are:

Is it any wonder that many private businesses and manufacturing enterprises are slashing wages? And, oh yes, deadbeats rule!

[1]. Joe Cash, Ellen Zhang, and Kevin Yao, “China’s Economy Slows as Consumers Tighten Belts, US Tariff Risks Mount,” Reuters, July 15, 2025. URL: https://www.reuters.com/world/china/chinas-q2-gdp-grows-52-yy-above-market-forecast-2025-07-15/.

[2]. “China’s June Industrial Output Rises by 6.8%, but Retail Sales and Investment Disappoints,” Seeking Alpha, July 15, 2025. URL: https://seekingalpha.com/news/4467301-chinas-june-industrial-output-rises-by-68-but-retail-sales-investment-disappoints.

[3]. Daniel Rosen and Jeremy Smith, “China’s Economic Performance: New Numbers, Same Overstatement,” Atlantic Council, January 16, 2025. URL: https://www.atlanticcouncil.org/blogs/econographics/sinographs/chinas-economic-performance-new-numbers-same-overstatement/#:~:text=Rhodium%20Group%20estimates%20that%20China’s,2024%2C%20well%20below%20NBS%20figures.

[4]. “China’s June Industrial Output Rises by 6.8%, but Retail Sales and Investment Disappoints,” Seeking Alpha, July 15, 2025. URL: https://seekingalpha.com/news/4467301-chinas-june-industrial-output-rises-by-68-but-retail-sales-investment-disappoints.

[5]. Anniek Bao and Evelyn Chen, “China’s Second Quarter Growth Beats Forecasts but Deflation Fears Fuel Calls for Deeper Reform,” CNBC, July 14, 2025. URL: https://www.cnbc.com/2025/07/15/chinas-second-quarter-gdp-growth-slows-to-5point2percent-as-economists-warn-of-mounting-headwinds-ahead.html#:~:text=The%20slump%20in%20real%20estate,infrastructure%20and%20manufacturing%20also%20slowed.

[6]. Daisuke Wakabayashi, “How Long Can China Keep Propping UP its Consumers with Subsidies?” New York Times, July 14, 2025. URL: https://www.nytimes.com/2025/07/14/business/china-economy-consumer-subsidies.html?campaign_id=2&emc=edit_th_20250715&instance_id=158504&nl=today%27s-headlines®i_id=57626452&segment_id=201886&user_id=3ba1b8d7b8a01907ae51c1b256a65253.

[7]. Evelyn Cheng, “Why aren’t Chinese Consumers Spending Enough Money?” CNBC, June 15, 2025. URL: https://www.nbcnewyork.com/news/business/money-report/why-arent-chinese-consumers-spending-enough/6303513/.

[8]. Qian Lang, “Widespread Pay Cuts in China Driving Down Consumer Spending, Fuel Deflationary Fears,” Radio Free Asia, June 17, 2025. URL: https://www.rfa.org/english/china/2025/06/17/china-economy-deflation-wage-cuts-layoffs/#:~:text=Chinese%20workers%20across%20industries%20are,%2Dend%2C%E2%80%9D%20said%20Li.

[9]. “Beneath China’s resilient economy, a life of pay cuts and side hustles,” Reuters, July 15, 2025. URL: https://www.reuters.com/sustainability/sustainable-finance-reporting/beneath-chinas-resilient-economy-life-pay-cuts-side-hustles-2025-07-15/.

[10]. “China Wage Data Goes Missing as Tariffs Imperil Millions of Jobs,” Bloomberg, May 9, 2025. URL: https://www.bloomberg.com/news/articles/2025-05-09/china-private-wage-data-goes-dark-with-jobs-at-risk-from-tariffs.

[11]. Liangping Gao and Marius Zaharia, “Feeling Poorer: Property Slump Hurting Chinese Consumers, Clouding Recovery,” Reuters, April 13, 2023. URL: www.reuters.com/markets/asia/feeling-poorer-property-slump-hurting-chinese-consumers-clouds-recovery-2023-04-14/.

[12]. Liangping Gao, Yukun Zhang, and Ryan Woo, “China Home Prices Fall at Fastest Pace in 8 Months, Stimulus Calls Rise,” Reuters, July 14, 2025. URL: https://www.reuters.com/markets/asia/chinas-new-home-prices-fall-fastest-pace-8-months-june-2025-07-15/#:~:text=BEIJING%2C%20July%2015%20(Reuters),growing%20calls%20for%20additional%20support.

[13]. “China Home Prices Drop at Faster Pace as Support Calls Mount,” Bloomberg, July 14, 2025. URL: https://www.bloomberg.com/news/articles/2025-07-15/china-home-prices-drop-at-faster-pace-as-stimulus-calls-mount?srnd=phx-fixed-income.

[14]. “China’s Home Prices Dip in May, Extending Two-Year Slump,” Reuters, June 15, 2025. URL: https://www.reuters.com/markets/asia/chinas-home-prices-dip-may-extending-two-year-stagnation-2025-06-16/.

[15]. Anniek Bao and Evelyn Chen, “China’s Second Quarter Growth Beats Forecasts but Deflation Fears Fuel Calls for Deeper Reform,” CNBC, July 14, 2025. URL: https://www.cnbc.com/2025/07/15/chinas-second-quarter-gdp-growth-slows-to-5point2percent-as-economists-warn-of-mounting-headwinds-ahead.html#:~:text=The%20slump%20in%20real%20estate,infrastructure%20and%20manufacturing%20also%20slowed.

[16]. “China’s Factory-Gate Deflation Worst in Two Years as Trade War Bites,” Reuters, July 8, 2025. URL: https://www.reuters.com/world/china/chinas-consumer-prices-rise-first-time-five-months-2025-07-09/#:~:text=On%20a%20monthly%20basis%2C%20the,the%20highest%20in%2014%20months.

[17]. Kevin Yao, “China’s GDP Growth Set to Slow, Raising Pressure on Policymakers,” Reuters, July 1, 2025. URL: https://www.reuters.com/world/china/chinas-gdp-growth-set-slow-raising-pressure-policymakers-2025-07-11/.

[18]. “China Can Maintain High Growth and Transition to Consumer-led Economy, Premier Li Says,” Reuters, June 24, 2025. URL: https://www.reuters.com/markets/asia/china-can-maintain-high-growth-transition-consumer-led-economy-premier-li-says-2025-06-25/.

[19]. “China Plans Nationwide Subsides to Boost Birthrate,” Bloomberg, July 3, 2025. URL: https://www.bloomberg.com/news/articles/2025-07-04/china-plans-nationwide-subsidies-to-boost-birthrate-growth.

[20]. “China’s Pension Crisis Deepens with Boycott from Millions of Youth,” Bloomberg, January 9, 2025. URL: https://www.bloomberg.com/news/newsletters/2025-01-10/china-s-pension-crisis-deepens-with-boycott-from-millions-of-youth.

[21]. Zongyuan Zoe Liu, “What Is the Chinese Pension System and Why are Its Problems Hard to Fix?” Asia Unbound and Asia Program, Council on Foreign Relations Blog Post, January 13, 2025. URL: https://www.cfr.org/blog/what-chinese-pension-system-and-why-are-its-problems-hard-fix.

[22]. International Monetary Fund, “Peoples Republic of China,” IMF Country Report No. 24/258, August 2024. URL: file:///C:/Users/danie/Downloads/1chnea2024003-print-pdf%20(1).pdf.

[23]. “Fitch Downgrades China to ‘A’; Outlook Stable,” Fitch Ratings Hong Kong, April 3, 2025. URL: https://www.fitchratings.com/research/sovereigns/fitch-downgrades-china-to-a-outlook-stable-03-04-2025#:~:text=%2D%20Structural%20Features:%20A%20material%20reduction,QO%20notch%20on%20structural%20features.

[24]. Kelly Ng, “China Raises Retirement Age for First Times Since 1950s,” BBC, September 13, 2024. URL: https://www.bbc.com/news/articles/c62421le4j6o.

[25]. Rogan Quinn and Logan Wright, “The Myth of China’s Fiscal Space,” Rhodium Group, August 29, 2023. URL: https://rhg.com/research/the-myth-of-chinas-fiscal-space/.

[26]. Noa Ronkin, “When the Storm Hit: How Covid Exposed China’s Flawed Fiscal System,” Freeman Spogli Institute for International Studies, Stanford University, May 6, 2025. URL: https://fsi.stanford.edu/news/when-storm-hit-how-covid-exposed-chinas-flawed-fiscal-system.

[27]. Kevin Yao, “China’s GDP Growth Set to Slow, Raising Pressure on Policymakers,” Reuters, July 11, 2025. URL: https://www.reuters.com/world/china/chinas-gdp-growth-set-slow-raising-pressure-policymakers-2025-07-11/.

[28]. Beneath China’s resilient economy, a life of pay cuts and side hustles,” Reuters, July 15, 2025. URL: https://www.reuters.com/sustainability/sustainable-finance-reporting/beneath-chinas-resilient-economy-life-pay-cuts-side-hustles-2025-07-15/.