A specter is hanging over China, namely the dreaded “D” word, or deflation. Over the past year, prices have been falling across its economy, giving rise to fears that China is on the cusp of a deflationary spiral. That is very bad news for its economic growth prospects. Even worse, to solve this brewing crisis, the Chinese Government has sought to boost output and supply across the economy. But that response ignores the main factor underlying China’s deflation problem, which is the persistently low share of private consumption in its gross domestic product (GDP). If Chinese private consumption levels remain depressed, raising output and supply could turn what is now a nascent deflation crisis into a full-blown downward price spiral.

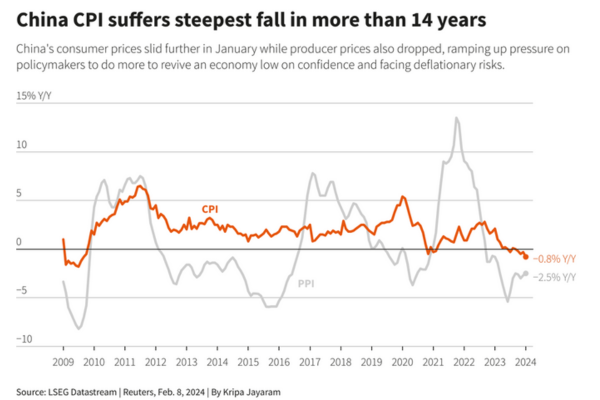

Last summer, data released by the National Bureau of Statistics of China [https://eastasiaforum.org/2023/10/21/chinas-unspoken-deflation-challenge/] showed a year-on-year drop of 0.3% in the Consumer Price Index (CPI) for July and a year-on-year drop of 4.4% on the Producer Price Index (PPI). The last time a simultaneous drop in the CPI and PPI occurred in China was in November 2020. The July drop in the CPI was the first decline in that index since February 2021, while the PPI had declined for 10 consecutive months in 2023 and 2022. Despite these worrisome trends, some high-level Chinese Government officials were in denial about the threat of deflation. Following the release of the July 2023 numbers, Fu Linghui, spokesperson for the National Bureau of Statistics of China, confidently declared “there is no deflation in China, deflation will not occur in the coming months.”

It now seems likely that Fu will have to eat those badly chosen words. As Reuters reported in a February 7, 2024 article,[https://www.reuters.com/world/china/chinas-consumer-prices-suffer-steepest-fall-since-2009-deflation-risks-stalk-2024-02-08/#:~:text=%22The%20CPI%20data%20today%20shows,to%20be%20entrenched%20among%20consumers.%22] the deflation problem in China just keeps getting worse. In January of this year, the CPI fell by 0.8% from the previous year, on top of year-on-year declines of 0.5% in November 2023[https://www.reuters.com/world/china/chinas-policy-dilemma-is-boosting-credit-deflationary-2024-01-10/] and 0.3% in December 2023. The January fall in the CPI was the biggest since September 2009, when the Chinese economy underwent a short but sharp downturn during the global financial crisis. The chief economist at Pinpoint Asset Management, Zhang Zhiwei, said of these data, “China faces persistent deflationary pressure,” adding that it “needs to take actions quickly and aggressively to avoid the risk of deflationary expectations to be entrenched among consumers.”

The latest ongoing fall in the CPI was accompanied by a continuing slide the PPI, which dropped 2.5% in January, after declining 2.7% in December vs. the 2.6% fall forecasted in a Reuters poll. At the same time, factory gate prices slipped 0.2% in January of this year, after plunging 3.0% in November 2023.[https://www.reuters.com/world/china/chinas-policy-dilemma-is-boosting-credit-deflationary-2024-01-10/]

To be sure, after recently enduring sharply rising inflation, which spiked at 8.3% in 2022, many Americans might welcome such a sustained drop in prices. However, the deflation China is currently experiencing risks creating a vicious negative feedback loop in which households hold back on spending in the expectation that goods and services will keep getting cheaper. While such behavior makes sense for individual households, it damages the aggregate economy by depressing consumer spending. That, in turn, may discourage private sector investment and negatively affect employment and incomes, thereby becoming a self-reinforcing dynamic weighing down economic growth. This is what Japan went through during its “lost decade” of the 1990s.

Indeed, as the statement by Zhang Zhiwei quoted earlier in this post notes, deflationary expectations may be well on their way to becoming entrenched among Chinese households. Zhang’s fears are echoed by Carlos Casanova, a senior Asia economist at Hong Kong Union Bancaire Privee, who is also quoted in the February 7th Reuters piece. In a recent note to clients about the Chinese economy, Casanova declared, “Deflation/Disinflation is becoming entrenched.”

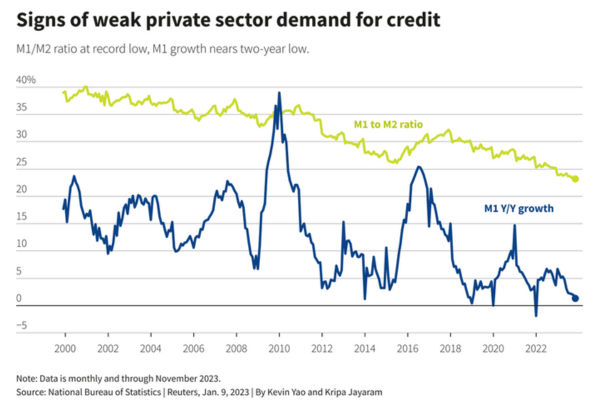

One sign that China may be at the cusp of a deflationary trap is weak private sector demand for credit during 2023, which is showing up in its money supply. An especially acute analysis of China’s deflation dilemmas in a January 9, 2024 Reuters article[https://www.reuters.com/world/china/chinas-policy-dilemma-is-boosting-credit-deflationary-2024-01-10/] notes that the ratio between the M1 money supply, comprised of cash in circulation and corporate demand deposits, and the M2 money supply, comprised of M1 plus fixed corporate, household, and other deposits, fell to a record low in November of last year.

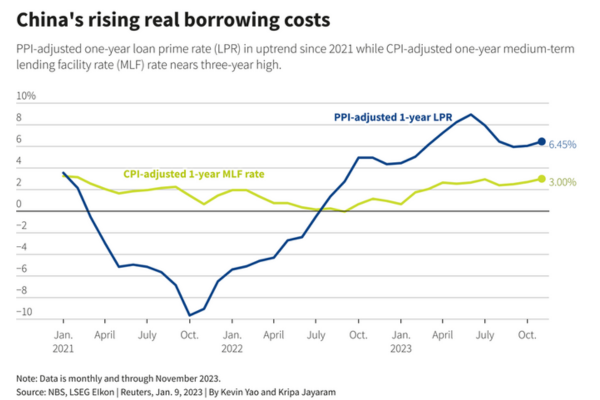

In the January 7th Reuters article, CITI analysts commenting on this trend declared, “Low M1 growth could be an indication of weak private business confidence, or a byproduct of the property downturn, or both, suggesting less satisfactory transmission,” adding, “This is really concerning.” Although the slumping real estate sector and loss of business confidence are surely playing are certainly at play here, falling prices are likely another key part of the equation. Deflation has widened the spread between prices and interest rates, thereby boosting real borrowing costs. Thus, while China’s Central Bank, the People’s Bank of China (PBOC) set its benchmark one-year loan prime rate at 3.45% at the end of 2023, the lowest since August 2019—this move followed a series of rate cuts—when adjusted for falling factory gate prices, this rate had actually risen to 6.45% in November 2023.

All through 2023, the PBOC eased monetary policy, cutting interest rates and bank reserve requirements. But during this period, it shifted the flow of credit and money away from the rickety property sector to infrastructure and manufacturing. Increased lending to manufacturing has focused on high-tech activities, especially semiconductors and electric vehicles,[https://www.reuters.com/world/china/with-manufacturing-loans-rising-can-china-avoid-new-supply-glut-2023-11-12/] with the aim of moving China up the industrial value chain. Indeed, according to the January 7th Reuters article, of the 21.58 trillion yuan ($3.01 trillion) in new loans issued from January-November 2023, only about 20% went to households, with rest flowing to businesses, principally big vs. small firms, including inefficient state-owned enterprises (SOEs).

Earlier this year, in January, responding to rising real borrow costs and continued sluggishness in China’s economy, the PBOC announced further, albeit relatively limited, monetary easing. Starting on February 5th, the PBOC is cutting reserve requirements for banks by 50 basis points,[https://www.cnbc.com/2024/01/24/china-to-cut-banks-reserve-ratio-by-50-basis-points-from-feb-5.html] which will create 1 trillion yuan ($139 billion) in long-term capital. At the same time, it lowered the 5-year prime loan rate by 0.25 basis to 3.95%;[https://apnews.com/article/china-economy-interest-rates-property-788f9829c2a13d4c755932ca892d7d26#:~:text=breaks%20scoring%20record-,China%20cuts%20key%20interest%20rate%20in%20the%20latest,boost%20its%20ailing%20property%20sector&text=BANGKOK%20(AP)%20%E2%80%94%20China’s%20central,on%20the%20ailing%20property%20market] the prime 1-year rate is being left unchanged at 3.45%. PBOC Governor Pan Gongsheng stated that the focus of this latest round of credit loosening is promoting “high quality real estate development”—what exactly that means was left unclear—and shoring up troubled Chinese equity and financial markets. I suspect though that a not insubstantial share of this credit expansion will flow toward the industries targeted during the 2023 round of monetary stimulus.

During the 2008-2009 global financial crisis and attendant economic shock, China responded by aggressively opening up the credit sluices to maintain manufacturing output and economic growth. The subsequent surge in factory output led to huge overcapacity in heavy industries like steel and cement. The latter became a poster child for this, with China pouring 60% of the world’s cement and its cement production in 2011-2013 surpassing U.S. production for the entire 20th century.[https://www.newsecuritybeat.org/2018/09/crushing-environmental-impact-chinas-cement-industry/] This history is being repeated in the latest Chinese effort to boost manufacturing output through credit expansion. Having massively increased its e-mobility productive capacity, China is facing serious excess capacity in both lithium-ion batteries[https://www.scmp.com/business/article/3253116/chinas-lithium-ion-battery-industry-faces-excess-inventory-production-capacity-ev-market-downshifts] and EVs, where excess output could amount to between 5 to 10 million vehicles per year.[https://www.reuters.com/breakingviews/china-ev-overcapacity-fix-would-be-crowd-pleaser-2024-01-22/]

It bears emphasizing one key difference between China’s excess productive capacity in 2008-2009 vs. today. In 2008-2009, the massive increase in the output of capital goods like cement and steel got absorbed domestically, as China embarked on a huge infrastructure-building and housing construction binge,[https://www.washingtonpost.com/news/wonk/wp/2015/03/24/how-china-used-more-cement-in-3-years-than-the-u-s-did-in-the-entire-20th-century/] rather than being dumped on global markets. The main buyers of the rising output of heavy industrial output were therefore local authorities financing infrastructure production, which racked up huge debts conducting this activity, and property developers building new housing. By contrast, the large numbers of EVs and, ultimately, EV-related products, as well as much of the other high tech manufacturing China is churning out will have to be purchased by households buying new cars, electronic gadgets, and the like.

There is little chance that foreign demand will buy up the growing Chinese high-tech output. In the case of EVs, for example, the European Union launched an investigation last year of Chinese EV subsidies and appears set on limiting both imports of these vehicles.[https://www.bloomberg.com/news/articles/2023-12-20/china-is-under-pressure-to-keep-exporting-electric-cars-to-the-eu?embedded-checkout=true] Chinese high-tech manufacturers will have to rely on domestic consumption to soak up their increased production of such goods. However, Chinese consumers are really not up to doing that.

In 2019, private consumption accounted for just 39% of China’s GDP.[https://www.ceicdata.com/en/indicator/china/private-consumption–of-nominal-gdp] That compares to a global average of 60%. According to a 2018 International Monetary Fund study,[https://www.imf.org/en/Publications/WP/Issues/2018/12/11/Chinas-High-Savings-Drivers-Prospects-and-Policies-46437] while the Chinese GDP per capita in purchasing power parity terms, which factors in price differences between countries, equaled that of Brazil, Chinese per capita consumption levels only matched those of Nigeria. This was before 2-3 years of draconian government-imposed Covid 19 lockdowns hammered household incomes and devastated small private business owners.

Thus, numerous economists have been calling for the central government to boost household income by handing out cash or consumption vouchers. For example, Peking University professor Huang Yiping[https://news.ifeng.com/c/8G2KuuY2d5c] urged Chinese leaders to “Save the economy at any costs, hand out money.” Such advice has been shunned by Xi Jinpin. Indeed, in language that would be at home among right-wing circles in America, China’s President has denounced the “trap of welfarism,”[https://www.scmp.com/economy/china-economy/article/3153362/what-lying-flat-and-why-are-chinese-officials-standing-it?module=perpetual_scroll_0&pgtype=article&campaign=3153362] arguing that cash assistance to needy people like unemployed college graduates would simply subsidize individual laziness.

A major ongoing drag on household consumption in China remains its patchy social safety net in pensions and health care. This forces individual Chinese to set aside large sums of money in precautionary savings to deal with health emergencies and insure adequate retirement income. In the case of pensions, the chronic underfunding of state pension schemes, which is being exacerbated by a shrinking workforce, is forcing young white-collar middle-class Chinese to begin setting aside large amounts of income to support themselves in old age. A recent survey conducted[https://www.sixthtone.com/news/1011679] by Fidelity International and Ant Fortune, a financial subsidiary of the online sales behemoth Ali Baba, found that Chinese start saving at the age of 35, down from 38, in 2021, with respondents stating that they set aside 27% of their monthly income for retirement vs. the 17% saved in 2019. These findings matter a great deal, as people in this young age bracket typically consume more than their older counterparts. In 2022, China’s patchwork of various health insurance schemes saw, according to a December 9, 2023 Financial Times report,[https://www.ft.com/content/0ef68e30-bbe7-4b6e-8d17-479a552be994] an unprecedented drop of 19 million enrollees, which followed years of growth. This fall continued through 2023 and was driven by rising premiums and co-payments, limited coverage, and squeezed household incomes. Dan Wang, chief economist at Hang Seng Bank, states in the article, “A lack of a social net, led by strong health insurance coverage, has forced Chinese people to save a significant portion of their income to prepare for external shocks, like diseases,” adding, “This has undermined government efforts to boost consumption.”

The report issued to the recently convened 2024 annual session of the Chinese People’s Political Consultative Conference by Premier Li Qiang, the second highest ranking official after President Xi, makes it clear that Beijing is unwilling to seriously address this problem. Reviewing this document, the New York Times[https://www.nytimes.com/2024/03/04/business/china-gdp-target.html?campaign_id=2&emc=edit_th_20240305&instance_id=116859&nl=todaysheadlines®i_id=57626452&segment_id=159986&user_id=3ba1b8d7b8a01907ae51c1b256a65253] notes that it says nothing about shoring up China’s shaky social safety net and other income transfers to households, like vouchers or coupons, that could quickly boost private consumption. At the same time, Chinese military spending is set to rise 7.2% this year, after a similar rise last year, bringing the defense budget up to $231 billion.

Once again, with China’s major trading partners less and less willing to tolerate it running large trade surpluses, increasing manufacturing output will have to be matched by growing internal consumption. Yet top Chinese leaders seem stubbornly resistant to enacting policies that could make that happen. In the absence of such move, continuing to boost industrial production in the face of low levels of household consumption only increases the amount of supply relative to demand. As everyone is taught in economics 101, that is a sure-fire formula for price deflation. Barring a major reversal of economic policy—I am not holding my breath here—China faces a high risk of falling into a deflationary trap and undergoing its own economic “lost decade.”