The return of Donald Trump to the White House has led to a marked escalation in Sino-American trade tensions. On April 2nd, the so-called “Liberation Day,” Trump imposed a 145% tariff on Chinese goods, which amounted to a trade embargo on China. While the President reversed course following backlash from financial markets and concerns over empty shelves in retail outlets, effective duties on Chinese imports remain punishingly high, at 30-50%. These rates could become even steeper if the US and China fail to make a new trade deal during the 90-day pause on the April 2nd tariffs announced on May 12th.

A lot of ink has already been spilled on which country will come out on top in this dispute. Following the May 12th tariff reversal, most of this commentary has argued that Xi Jinping has gained the upper hand, pointing to Trump’s ham-fisted conduct of trade negotiations with China (and most other countries). While all of that is true, it also bears emphasizing that the Chinese economy remains highly vulnerable to the shock generated by Trump’s tariffs. After reviewing these vulnerabilities, I will discuss how China might respond to the latest souring of trade relations with the US.

HOW THE TRUMP TARIFF SHOCK HARMS THE CHINESE ECONOMY

China’s vulnerabilities in the newly escalated trade war with America largely stem from its heavy dependence on exports to drive economic growth. That dependence is rooted in sluggish Chinese domestic consumption. Although household spending per capita has steadily increased over the past decade, it remains very low[1] compared to developed Asian economies. Last year, for example, annual Chinese household spending per capita amounted to just $4,802 vs. $8,258 for Japan and $15,353 for South Korea. At the same time, Chinese household savings deposits have risen substantially, standing at 152 trillion RMB in 2024, up from 82 trillion RMB in 2019. The stagnation in consumption has been paralleled by a major government push to ensure China’s manufacturing dominance, leading to rising levels of industrial output, particularly in sectors deemed to be “new productive” forces. This has resulted in an ever-widening gulf[2] between what China produces and what it consumes. Estimates of China’s share of global manufacturing output put it at between 29 to 35% vs. just a 13% share of global consumption, despite China being the world’s second most populous country.

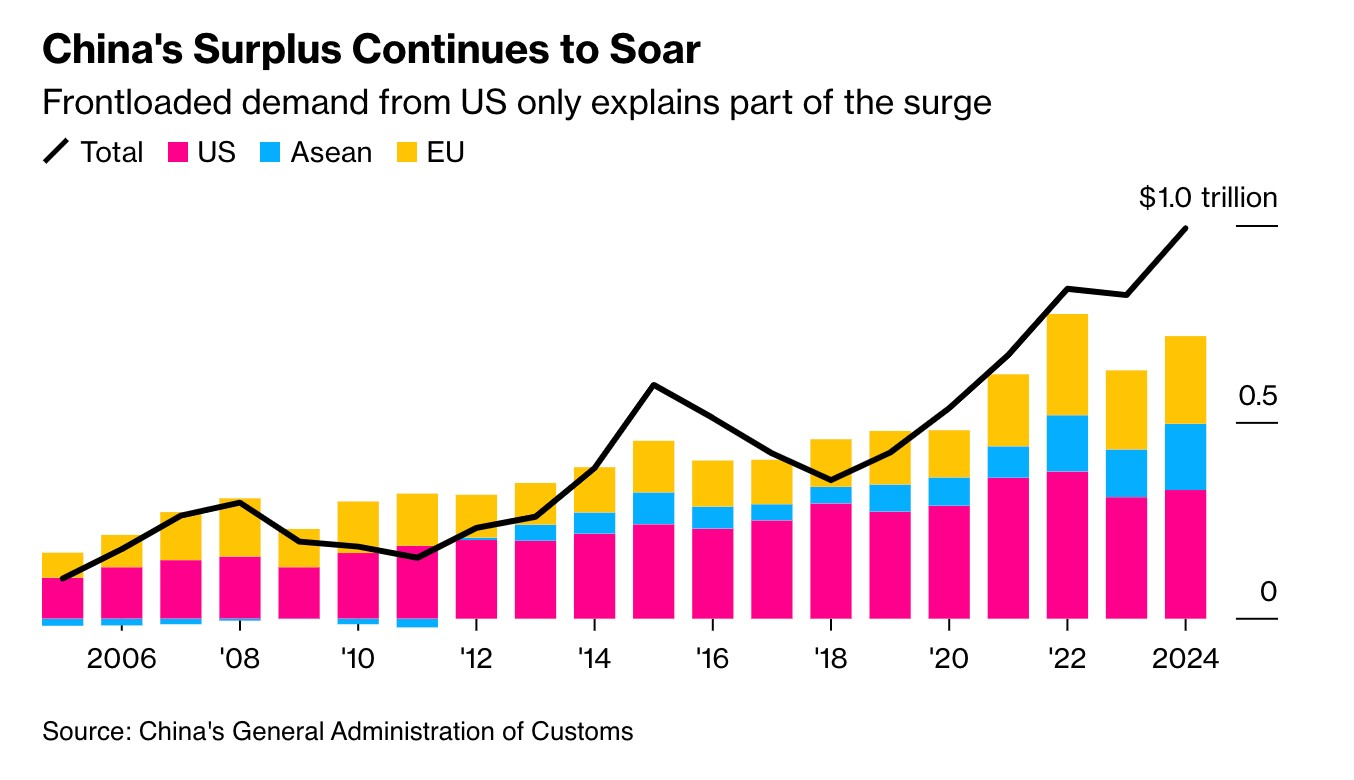

It is hardly surprising that China’s current account surplus, or gap between what it exports and imports, has shot up since 2018. This trend, it could be added, is driven by both increasing exports and weak demand for foreign goods; the latter is another indicator of anemic household consumption.

Last year, according to data from the US Trade Representative,[3] America imported $438.9 billion from China, up 2.8% ($12.1 billion) from 2023.

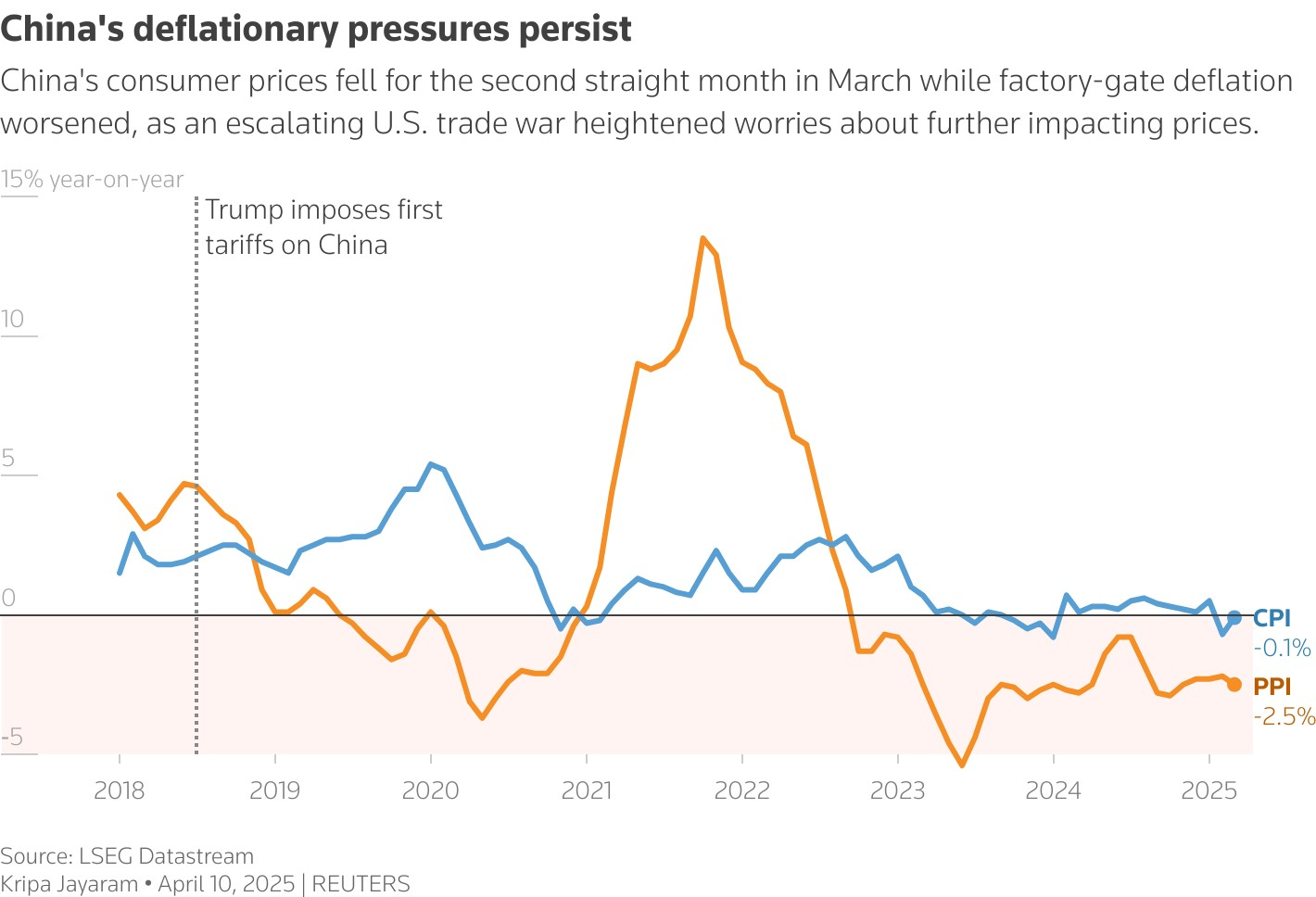

Given these numbers, losing most, if not all, of its access to the US market would be major shock to China’s economy. If other export markets cannot take the place of the US—more on that in the next subsection of this post—lots of industrial output that had been sent abroad gets stuck in China. Firms will react by cutting production, realigning supply with demand over time, but the backlog of previously produced and formerly exported but now unsold output will generate a temporary glut in the supply of goods. This impact is borne out in the latest Caixin/S&P Global Manufacturing Purchasing Managers’ Index[4] released over the weekend of May 31st-June 1st. According to that survey, the finished goods inventories of Chinese factories rose for the first time in four months during May, reflecting falling sales and delays in shipments to foreign customers caused by higher US tariffs. With Chinese consumer spending remaining weak, these bigger inventories could cause a sharp, if short-lived, downward price spike. That, in turn, will add to the already strong deflationary pressure on the economy.

The specter of deflation had been looming over the Chinese economy well before Trump’s April 2nd escalation of the trade conflict. The past two years has seen a flat-lining of the Consumer Price Index, while factory gate prices, the Producer Price Index, has been in negative territory for the past 30 months. The trade war with America could help tip China into a full-fledged deflationary spiral.

The recent Caixin PMI indicates that manufacturing activity in China fell in May at its fastest pace since September 2022, when economy was under a severe Covid lockdown. The index tumbled below 50, signifying contraction, to 48.3, down from 50.4 in April and coming below the 50.6 medium estimate of Reuters. The Caixin survey focuses mainly on export-oriented firms, many of which are small- to medium-sized private enterprises, so these latest numbers underscore the negative fallout from Trump’s escalation of the trade tensions with China.

That fallout will include rising unemployment. Alicia Garcia-Herrero, chief Asia Pacific economist at Natixis, calculates[5] that 100%+ US tariffs could lead to 6-9 million job losses. Even with the reduction in tariffs to 30-50% during the post May 12th pause, she believes that 4-6 million layoffs are possible, while a further 20% reduction in duties would still lead 1.5-2.5 million lost jobs. Garcia-Herrero notes, “When you increase the tariffs to such a high level (over 100%), many companies decide to stop hiring and start basically sending the workers back home,” adding, “At 30%, I doubt they will say, okay, come back. Because it’s still high.” The factory closures brought on by the recent hotting up of the trade war with the US, combined with the anger of newly unemployed workers over unpaid wages, is causing a surge in labor unrest and social protest[6] across China.

Although China’s vulnerabilities in the face of escalating American tariffs are mainly tied to its exports, it also faces risks related to the import side of its trade with the US. These stem from the continued dependence on US-based supply chains in the drive to achieve dominance in so-called “new productive forces.”

One such area that has been the focus of attention is advanced information technology and AI. Both the first Trump and Biden Administrations sought to hobble Chinese ambitions to secure global leadership in these fields by restricting its access to advanced American computer chips, as well as other components from US allies, like Taiwanese semi-conductors. Now that he is back in office, Trump is further tightening controls over China’s ability to acquire these parts of the high-tech supply chain.

This behavior is now being extended to other attempts by China to upgrade its manufacturing capability. Responding to foot-dragging over resuming rare earth mineral exports to the US following the May pause in the trade war, Trump curtailed sales[7] to China of critical engine and navigation system components and software for large passenger aircraft. This move will further delay the Commercial Aircraft Corporation of China’s development of the C919, a single aisle jetliner similar to the Boeing 737. Despite being plagued with difficulties, the C919 project has assumed oversized importance within the government and wider public. It has become a symbol of Chinese efforts to move up the industrial value chain, as well as the strong desire of Beijing to break Boeing and Airbus’s monopoly over the production of commercial passenger airliners.

Under Xi Jinping, China has tried to immunize itself against foreign pushback on trade, particularly after its experience with the first Trump Presidency. Yet despite all of its endeavors to do that, which have centered around dominating global supply chains,[8] China remains highly vulnerable to Trump’s renewed attempt to upend its trading relationship with the US. The main question now is how it reacts to this shock. Does China try to stick with relying on exports as an economic growth engine or rebalance its economy away from trade and investment and toward domestic consumption?

CHINA RESPONDS TO TRUMP, 1, DOUBLING DOWN ON EXPORTS, GOING LIGHT ON DOMESTIC ECONOMIC STIMUS

One obvious Chinese response to Trump’s trade war is simply to ship more goods to countries other than the US to offset the loss of exports caused by higher Amiercan tariffs. Doing that would enable China to maintain manufacturing exports without having to relocate factories and their jobs to countries subject to lower US tariffs.

This is precisely what Chinese leaders attempted to do in reaction to the tariffs Trump imposed on China during his first term, when they tried to forge closer trading relations with the European Union (EU). These efforts seem to have paid off: in 2023, the value of Chinese goods exported to the EU amounted to €515.9 billion,[9] while the value of Chinese goods sent to the US came to $501.2 billion.[10] Over the past few months, China’s trade with America has slumped, but its exports have continued to rise, driven by a surge of goods going to Europe and Southeast Asia.[111] This shift is also reflected in the graph presented earlier on China’s current account surplus, which shows the EU and Association of Southeast Asian Nations (ASEAN) accounting for a growing share of that surplus relative to that of the US.

The problem for China is that rerouting trade is probably not a viable long-term strategy for dealing with high US tariffs. Chinese trade practices vis-à-vis countries other than the US has provoked its own strong backlash. In the case of the EU, trade tensions have mounted over the past year, with Europe accusing China of not taking it “seriously.” On June 2nd, EU governments limited imports of Chinese medical devices,[12] citing discrimination against European firms on the Chinese market. In Southeast Asia, the influx of Chinese manufactured goods[13] is sparking growing alarm among local manufacturers and calls for government action, particularly in Thailand, Malaysia, and Indonesia. Trade friction with China has extended to its fellow BRICS group members. In October of last year, Brazil imposed tariffs on Chinese imports,[14] including a 35% increase on duties for fiber optic and cable and a 25% boost in iron and steel products. Chinese manufacturers are encountering trade headwinds even in Russia, notwithstanding the Xi-Putin pledge of a “no limits” strategic partnership. China’s car exports to Russia dropped by nearly half[15] year-on-year in the first two months of this year. This fall came after the Russian government implemented taxes aimed at protecting domestic car makers from Chinese vehicles.

Chinese companies might also deal with high US tariffs by relocating production to other countries and exporting that output to the American market from those locations. A February 2025 Rhodium Group study[16] focused on the manufacturing diversification decisions of firms in four sectors, apparel, consumer electronics, solar panels, and motor vehicles (EVs and non-EVs), the first two of which are important components in the US-China trade gap. The study finds that US tariff hikes on these industries will accelerate the moves they had already been making to relocate production outside of China—interestingly, it observes that this process is further along in consumer electronics than in apparel. But the study further notes that whether this happens depends heavily on US tariffs on China exceeding those on the countries where Chinese firms have outsourced production. These are largely in Southeast Asia, but also include Mexico, parts of the Middle East/North Africa, and Europe. If that is not the case, Chinese companies will be less incentivized to engage in foreign direct investment (FDI) to manufacture goods and build the supply chains that goes into doing that. They may opt instead maintain production in or even “reshore” it back to China.

The unpleasant tradeoff in this strategy for sidestepping high US tariffs on goods made in China is additional factory job losses in China, which would come on top of the ones stemming from the latest escalation of the trade war. Outsourcing production will inevitably diminish employment on the shop floor and assembly line within China, even if it creates higher-end work opportunities in areas like design and marketing. Large numbers of Chinese employed in manufacturing would face significant economic dislocation. As happened when American factories moved to Mexico in the wake of NAFTA, China may face a labor backlash against the outsourcing of manufacturing jobs and attendant growth in social unrest. That is not something the government, with its overriding concern about maintaining order and stability, would welcome.

The Rhodium Group’s analysis of production diversification decision-making among Chinese companies suggests that such a scenario may, for now at least, be less likely to play out. Following May 12th, tariffs on China have fallen, bringing them more in line with the import duties Trump might slap on the countries where Chinese firms have diversified production. Vietnam, which has been a hot spot for Chinese manufacturing FDI, faces a 35% US tariff on its exports[17] once the 90-day pause on the “reciprocal” tariffs Trump announced on April 2nd ends this summer. That tariff is equivalent to the tariff now being imposed on China. This reduces the incentive of Chinese manufacturers to set up shop in Vietnam and elsewhere, while those who have already done that are more likely to “reshore” production (other Southeast Asian countries that have been heavy recipients of Chinese FDI also face high US tariffs[18]). Of course, the chaos around trade policymaking in the Trump Administration has created huge uncertainty about tariff outcomes, including the possibility of very high import duties being reimposed on China.

Assume, however, for a moment that the tariffs Trump imposes on China do not significantly exceed the ones that slapped on other countries. This scenario could accentuate the supply shock to the Chinese domestic market caused by the combination of US tariffs and ongoing weak household consumption. Since it is unlikely that output that was previously exported to US can be rerouted to other foreign markets, the tariffs will, as noted earlier, result in a glut of unsold goods while firms curtail production to bring supply in line with demand (they could also keep producing by selling at a loss or with government assistance). That glut could be made worse if Chinese factories operating abroad “reshore” back to China. “Reshoring” firms may decide to make a go of producing in China by cutting their costs, including doing that with fewer workers, rather than ceasing to operate. Inventories of unsold products would become even greater, putting additional downward pressure on pressure on prices and enhancing deflationary risks.

In his speech opening the 2025 annual meeting of the Chinese National People’s Congress in March, Premier Li Qiang laid out the government’s plan for softening the blow of the Trump tariff shock on China. That address stood out mainly for mentioning “consumption” nearly as often as “technology,” marking a major shift from his 2024 address to that body. Such rhetoric aside, the actual proposals for boosting household consumption[19] amounted to small beer. Harry Murphy Cruise, head of China and Australia Economics at Moody’s Analytics, notes that beyond expanding the consumer subsidy scheme for electric vehicles, appliances, and other goods, support for household spending “is still very weak.” In particular, the boost in welfare expenditures were extremely modest, with the monthly minimum pension payment rising by 20 RMB to 143 RMB ($20).

In early May, the People’s Bank of China (PBoC) said it would loosen monetary policy[20] by cutting key policy rates by 10 basis points and lowering the amount of cash banks must keep in reserve by 50 basis points. The PBoC also proposed to set up low-cost relending facilities for repurchasing tech-related bonds and for investing in elderly care services and consumption. This new round of stimulus left Chinese financial markets underwhelmed. The benchmark index on Mainland Stock Markets hardly budged after the PBoC announced its latest credit easing, while the Hong Kong Hang Seng Index rose by less than 0.4%. Neo Wang, lead China economist and strategist at Evercore ISI, called these moves “nothing but stopgap instead of a solution.”

CHINA RESPONDS TO TRUMP, 2, REBALANCING THE ECONOMY AWAY FROM EXPORT DRIVEN GROWTH (?):

Chinese responses to the threat of high US tariffs reviewed so far all seek to counter it while sticking with a manufacturing-intensive economic strategy based on high levels of investment and exports. In view of the problems with maintaining that course, one might speculate whether the Trump shock might provide the push needed for China to finally jettison its older economic growth model. As the old and oft-invoked Chinese phrase goes, “危机即是机遇” (wēijī jí shì jīyù), or literally “danger (危机) equals opportunity (机遇).”

The need for economic rebalancing has long been recognized, going back to former Premier Wenjiao Bao’s memorable “four uns,” which described China’s economy as “unstable, unbalanced, uncoordinated, and unsustainable.” The trade war has led to renewed calls for economic rebalancing toward consumption. These voices include Huang Yiping,[21] Dean of the National School of Development, as well as Distinguished Professor at Peking University and member of the PBoC Monetary Policy Committee. If China were to do this, it would certainly defuse rising trade tensions between it and the US (and rest of the world).

This rebalancing is much easier said than done. It would basically require a huge surge in consumer spending, which currently accounts for just 39% China’s GDP,[22] well below the average for both developed and comparable higher middle-income economies. This gap reflects both the low earnings of many ordinary Chinese, especially those living in the countryside and urban rural migrant workers, and the higher propensity of better off households to save rather than spend. The latter behavior stems from a weak social safety net, particularly in old age pensions and health care, which incentivizes people to set aside funds for liabilities related to sickness and old age/retirement, rather than spend it on goods.

The importance of this behavior in China’s rise as an industrial juggernaut is well known. Due to restrictions on sending money outside of China and the dodginess of investing in domestic stocks, these savings are largely trapped in low-yielding bank saving accounts. That “financial repression” frees up the banks, nearly of which are state-owned, to deploy massive amounts of cheap credit for investment in manufacturing firms, along with the industrial parks, urban planning, and large-scale infrastructure accompanying such efforts. The state targets sectors seen as strategically important, like EVs,[23] for such assistance, while also encouraging fierce competition among numerous firms within these industries. This rivalry pushes companies to innovate rapidly in order to survive, driving down costs and making their products affordable within and outside of China. The few enterprises that survive become national and international champions, like BYD, which is now a global leader in the EV sales. China’s particular brand of industrial policy and industrial ecosystem around it has turned the country into both the workshop of the world and its premier manufacturing goods export platform.

In a recent New Yorker magazine interview,[24] MIT professor Huang Yasheng observes that China’s success in achieving manufacturing preeminence has come at considerable cost to ordinary households. They have had to transfer income, via the mechanism of forced savings stemming from a rickety social safety net, to the state and business enterprises receiving government support. If China is to significantly boost household consumption, Huang argues that it must redirect investment toward social protection, above all in pensions and health care, to free up households to spend more and save less.

To be sure, the Chinese leadership has taken a big first step in this direction, one that goes well beyond the limited stimulus measures announced in March of this year. That step is the ambitious 5-year plan introduced last year by the State Council to abolish the longstanding household registration system,[25] or Hùkŏu (户口). The Hùkŏu has severely disadvantaged the enormous “floating population” of hundreds of millions of people who have left the countryside to find better work opportunities in urban manufacturing centers. Because they hold rural, rather than urban Hùkŏus, rural migrant workers are unable to access the education and welfare benefits enjoyed by city dwellers. This has created a large economically marginalized “floating” population of several hundred million people residing in cities across China. Abolishing the Hùkŏu, which has long been advocated by Chinese economists, would markedly improve the economic condition of China’s largest underclass, enhancing their ability to buy more goods and helping to rebalance the economy toward consumption.

The proposed Hùkŏu reform points to a major obstacle to economic rebalancing, the fiscal capabilities of Chinese local governments. Abolishing the Hùkŏu is going to be very costly for municipal authorities, as they would be burdened with having to provide schooling for migrant children and better welfare benefits for their parents (local authorities are also on the hook for implementing the March stimulus measures). That will be a hard lift, due to the dire financial condition of cities across China, which rely heavily on income from land sales to fund government operations. This income has been hammered by the ongoing real estate crisis, falling by 16% over the past year.[26] These shrinking revenues, coupled with the generally dysfunctional fiscal relationship between Beijing and provincial and local authorities, has led to soaring levels[27] of “off the books” local government debt, tucked away in so-called Local Government Finance Vehicles. That debt now amounts to $8-10 trillion.

On top of the ongoing financial crisis in local government, China’s central government is now experiencing fiscal strains.[28] Last year, overall tax revenue fell by 3.4%. Individual income tax receipts and the haul from value added taxes came in at 7.5% and 7.9% below expectations, respectively, reflecting lower salaries, increased layoffs, and weak consumption. The deterioration in central government finances, along with the rapid growth of local government debt, led Fitch to downgrade of China’s credit rating from A+ to A in April. Jeremy Zook, director of Asia and Pacific sovereign ratings at the agency, observed, “Deficits are quite high and debt is rising quite quickly, so they are fiscally challenged.”

As things stand now, Chinese central and lower-level government authorities will struggle to finance even limited stimulus measures, let alone take major steps to rebalance the economy toward consumption. China badly needs to overhaul its tax system, whose highly regressive nature acts as a further brake on household consumption. Although income is subject to progressive taxation, the central government relies heavily on Value Added Taxes, which fall disproportionately on lower- and middle-income households. Capital gains are lightly taxed by international standards, while there are no taxes on gifts and inheritance. Last but certainly not least, local governments do not levy property taxes—hence the high dependence of such entities on land sales. But efforts to institute property taxes and higher taxes on income from investment, gifts, and inheritance have all met strong resistance[29] from within the government and elites connected to the state.

Even if China significantly improves state fiscal capability, it will still confront major financial tradeoffs associated with strengthening the social net to achieve economic rebalancing. These tradeoffs involve not only redirecting investment away from industrial policy to social protection, but two areas Chinese leaders have deemed to be urgent national priorities. One is costly effort to strengthen the military, which is seen as essential if China is to compete with the US in geopolitical rivalry; the other is the Belt and Road overseas investment scheme for projecting Chinese “soft power.” It also bears emphasizing that bolstering retirement security for ordinary households will be complicated by China’s rapidly aging population. This demographic crisis will massively increase future government pension liabilities, even in the absence of any attempt to improve benefits for retirees.

Finally, even though a clear path exists for economic rebalancing involving fiscal reform and shifting government spending priorities, it is not at all clear that any will exists among current Chinese leaders to go down that road. That unwillingness is reflected not just in the opposition to overhauling the tax system noted above. A deeper and more fundamental problem is the close alignment between China’s current economic growth model and its distinctive brand of top-down authoritarian state capitalism, where the state and Communist Party direct the economy, determining which industries thrive and which go bust. Expanded social protection, coupled with a more open economy led by market demand, rather than government dictates, would not just boost the influence of private businesses and lower- and middle-income households. It would also involve the state and Communist Party surrendering power, something that is resolutely at odds with where Xi Jinping wants to take China.

The President is instead clearly bent on staying the current economic course. He has expressed skepticism[30] about rebalancing the economy toward more household spending, condemning American-style consumption as “wasteful,” while brushing aside the threat of deflation, asking, “What’s so bad about deflation? Don’t people like it when things are cheaper?” Deflation is now a taboo subject,[31] with the word being banished from official discourse and economists falling out of favor for expressing pessimistic about the economy. Xi has doubled-down on the old growth playbook, steering large amounts of capital toward “new productive forces”—EVs, green energy, information technology, AI, and the like. Between 2019-2024, fixed asset investment in such industries grew at a 10-17% annual clip, compared to the 7.5% growth rate for manufacturing as a whole (real estate experienced net negative investment). This trend reflects the increasingly dual track[32] nature of China’s economy, juxtaposing dynamic technologically advanced manufacturing activities against an ailing real estate sector and older less rapidly growing industries. It is little wonder that Xi views the latest rise in trade tensions with the US as another step in China’s effort to dominate global manufacturing supply chains.[33]

CHINA HEADING DOWN A BLIND ALLEY?

In the current trade negotiations with the Trump Administration, President Xi has clearly been in no rush to make major concessions. In doing this, he is betting heavily on TACO (Trump Always Chickens Out), an acronym coined by a Financial Times journalist and now hugely popular online meme. This calculation was borne out by Trump’s backing down from the 145% tariffs he imposed on China in April. But the latest London round of US-China led only to limited concessions on both sides[34]—more Chinese rare earth mineral exports and renewed American shipments of jetliner engine and navigation system components and software. Otherwise, the two sides are back to where they were following the May 10-11th Geneva talks, with US tariffs on China still remaining high at 30-50%.

The negative macro-economic impacts from even that lower tariff rate are going to be significant. China will see manufacturing employment contract, while deflationary pressure will go up. All of this will be hitting an economy already burdened by slowing growth stemming from weak consumer demand, the ongoing housing crisis, and, over the longer term, highly adverse demography.

Moreover, major obstacles stand in the way of China continuing to export its way out of these problems. It faces a growing backlash on trade not only from the US, but other countries as well, including ones seen as allies. Rerouting trade to other countries to offset the loss of exports to the US is therefore not a viable long-term strategy. Nor is having Chinese manufacturers diversify production to and export from countries subject to lower US tariffs (especially now that Trump seems bent on imposing high tariffs on everyone). Finally, the limited government stimulus measures unveiled this spring by the government fall far short of what is needed to offset the adverse fallout from the Trump tariff shock.

That last point spotlights a basic dilemma confronting Chinese leaders. The kind of massive domestic stimulus that could truly insulate China’s economy from a foreign trade backlash requires, as was emphasized earlier, a significant redirection of investment to social protection to boost domestic consumption. But doing this would make it difficult for China to sustain the industrial policy that has underpinned its growing dominance over global manufacturing trade. That policy depends on having the large pool of trapped savings, which enables banks to provide cheap credit to targeted industries. A robust social safety net not only redices household precautionary saving behavior, but leaves fewer funds available for government subsidies to industries and individual businesses.

For the time being, the current Chinese leadership seems determined to cling to the old economic growth model and dream of dominating industrial supply chains. The only way for China to keep going down this path economically is for the US to back down on tariffs and reopen its market for Chinese exports. But if the Trump Administration just sticks with the existing 30-50% tariff rate, let alone go back to a 100+% rate, China is in for serious economic pain. It simply has no good response other than beginning to seriously rebalance its economy away from investment and trade. The reluctance of Xi to do this and his determination to stay the current economic course risks driving the Chinese economy into a blind alley.

Besides offering China a graceful off ramp from the trade conflict with the US, rebalancing the economy toward more consumption could put it on a more sustainable future growth path. In a lengthy paper and address[35] given to the Beijing-based think tank, The Center for China and Globalization (disclosure alert, I worked there for 2+ years as a research fellow), the prominent Chinese economist, Zhou Tianyong from the Northeast University of Finance, argued that rebalancing, coupled with major market reforms, is the only way for China to achieve the sacrosanct 5% annual growth target set by recent governments.

Fortunately, for Xi, he can always hope for the TACO factor. More seriously, besides TACO, Xi has a big ace up his sleeve—excuse me, but our President loves talking about leaders having or not having cards—namely US economic vulnerabilities vis-à-vis China, combined with Trump Administration ineptitude in making trade policy. I plan on taking up these matters soon. For now, it suffices to say that like nearly all economists, I believe that in trade wars, no one “wins.” This current trade war between China and America will be no exception to that rule.

[1]. “Consumer Spending: China Struggle to Return to Pre-Pandemic Spending Levels. Boosting China’s Consumer Confidence is now the Number One Priority of the Government, but it will be a Slow and Difficult Process,” CKGSB Knowledge, April 28, 2025. URL: https://english.ckgsb.edu.cn/knowledge/article/consumer-slump-in-china-economy-analysis-policy/#:~:text=Despite%20reaching%20surprising%20highs%20during,spend%20as%20they%20once%20did.

[2]. Michael Pettis, “What Will It Take for China’s GDP to Grow at 4–5 Percent Over the Next Decade?” China Financial Markets, December 4, 2023. URL: https://carnegieendowment.org/china-financial-markets/2023/12/what-will-it-take-for-chinas-gdp-to-grow-at-4-5-percent-over-the-next-decade?lang=en.

[3]. “The People Republic of China: China Trade Survey,” Office of the US Trade Representative, no date. URL: https://ustr.gov/countries-regions/china-mongolia-taiwan/peoples-republic-china.

[4]. Annie Bao, “China’s May Factory Activity Unexpectedly Shrinks as Tariffs Dent Sentiment—Worst Drop since 2022,” CNBC, June 2, 2025. URL: https://www.cnbc.com/2025/06/03/chinas-may-factory-activity-unexpectedly-shrinks-clocking-its-worst-drop-in-nearly-3-years-caixin-.html.

[5]. “Tariff Cuts Ease Mass China Layoffs, but Job Market Pain Persists,” Reuters, May 15, 2025. URL: https://www.reuters.com/business/world-at-work/tariff-cuts-ease-mass-china-layoffs-threat-job-market-pain-persists-2025-05-16/.

[6]. Ani, “China Sees Surge in Worker Protests over Unpaid Wages, Factory Closures and US Tariffs,” The Tribune, May 1, 2025. URL: https://www.tribuneindia.com/news/world/china-sees-surge-in-worker-protests-over-unpaid-wages-factory-closures-and-us-tariffs/.

[7]. Keith Bradsher, “Trump has Targeted a Plane China Sees as a Power Symbol,” New York Times, May 30, 2025. URL: https://www.nytimes.com/2025/05/30/business/china-comac-c919-trump.html.

[8]. David Pierson, “This is the Trade Conflict Xi Jinping has been Waiting For,” New York Times, May 10, 2025. URL: https://www.nytimes.com/2025/05/10/world/asia/xi-jinping-china-trade-war.html.

[9]. “EU trade relations with China, Facts, Figures and latest Developments,” European Commission, Trade and Economic Security, China, no date. URL: https://policy.trade.ec.europa.eu/eu-trade-relationships-country-and-region/countries-and-regions/china_en#:~:text=The%20EU%2DChina%20trade%20balance%20has%20been%20persistently,year%2Don%2Dyear%20decreases%20of%203.1%%20and%2018%%20respectively.

[10]. “China Exports to United States,” Trading Economics, no date. URL: https://tradingeconomics.com/china/exports/united-states

[11]. “Chinese Exports to the US Slump 21% but Soar to Asia and Europe,” Bloomberg, May 9, 2025. URL: https://www.bloomberg.com/news/articles/2025-05-09/china-s-april-exports-rise-even-as-tariffs-undercut-us-shipments.

[12]. “EU Backs Curbs on Chinese Medical Device Firms in Public Tenders,” Reuters, June 3, 2025. URL: https://www.reuters.com/world/china/eu-backs-curbs-chinese-medical-device-firms-bidding-public-tenders-2025-06-02/.

[13]. “Cheap Chinese Goods are Flooding Southeast Asia. Can the Region Turn the Tide? Be it Cabinets or Clothes, Cut-Throat Rivalry from China is Disrupting Local Businesses and Livelihood. Insight Surveys the Damage and Asks What’s Next?” The Straits Times, May 17, 2025. URL: https://www.straitstimes.com/asia/se-asia/cheap-chinese-goods-are-flooding-south-east-asia-its-manufacturers-are-fighting-back.

[14]. Igor Patrick, “Duties on a Range of Imports, Including Iron, Steel, and Fibre Optics, Come less than a Month before Xi Jinping is to visit Rio de Janeiro,” South China Morning Post, October 20, 2024. URL: https://www.scmp.com/news/china/diplomacy/article/3283014/brazil-imposes-new-tariffs-imports-china-bid-fight-dumping.

[15]. “Chinese Car Exports to Russia Hit by Taxes, Consumer Uncertainty,” Bloomberg, April 9, 2025. URL: https://www.bloomberg.com/news/articles/2025-04-09/chinese-car-exports-to-russia-hit-by-taxes-consumer-uncertainty.

[16]. Agatha Kratz, Lauren Piper and Juliana Bouchaud, “China and the Future of Global Supply Chains,” Rhodium Group, February 4, 2025. URL: https://rhg.com/research/china-and-the-future-of-global-supply-chains/.

[17]. Kimberley Long, “Trump’s Tariffs Could Wipe 2% off Vietnam’s GDP, Says Economist,” The Banker, May 23, 2025. URL: https://www.thebanker.com/content/9cec81cf-e6ed-486f-a631-70cf79f2e78c#:~:text=The%2046%20per%20cent%20tariff,will%20be%20imposed%20on%20products.

[18]. Alexandra Stevenson, “Trump Took a Wrecking Ball to Southeast Asia’s Role as an Alternative to China,” New York Times, April 3, 2025. URL: https://www.nytimes.com/2025/04/03/business/trump-tariffs-vietnam-southeast-asia.html.

[19]. Antoni Slodkowski, Laurie Chen, Jing Xu, and Eduardo Baptista, “China Ramps Up Stimulus to Guard Economy from Changes ‘Unseen in a Century,” Reuters, March 4, 2025. URL: https://www.reuters.com/world/china/chinas-parliament-meets-shield-economy-us-tariff-salvos-2025-03-04/.

[20]. Annie Bao, “China’s Latest Stimulus Fail to Impress as Investor Focus on US Trade Talks,” CNBC, May 8, 2025. URL: https://www.cnbc.com/2025/05/08/china-latest-stimulus-measures-us-trade-talks.html.

[21]. “How Should China Respond to Trump’s Tariffs?” Project Syndicate, April 11, 2025. URL: https://www.project-syndicate.org/commentary/china-must-boost-economic-growth-foster-open-trade-in-response-to-trump-tariffs-by-huang-yiping-2025-04

[22]. Logan Wright, Camille Boullenois, Charles Austin Jordan, Endeavour Tian, and Rogan Quinn, “No Quick Fixes: China’s Long-term Consumption Growth,” Rhodium Group, July 18, 2024. URL: https://rhg.com/research/no-quick-fixes-chinas-long-term-consumption-growth/.

[23]. Huang Yasheng, “China Plan to Fight Trump’s Trade War,” interview, New Yorker, April 17, 2025. URL: https://www.newyorker.com/news/q-and-a/chinas-plan-to-fight-trumps-trade-war.

[24]. Mokter Hossain, “How Chinese Companies are Dominating Electric Vehicle Market Worldwide,” California Management Review, March 2024. URL: https://cmr.berkeley.edu/2024/03/how-chinese-companies-are-dominating-electric-vehicle-market-worldwide/#:~:text=The%20competitive%20edge%20of%20Chinese,%2C%20government%20support%2C%20and%20innovation.

[25]. Lizzi Lee, “China Unveils Ambitious 5-Year Plan to Overhaul the Hukou System,” The Diplomat, August 2, 2024. URL: https://thediplomat.com/2024/08/china-unveils-ambitious-5-year-plan-to-overhaul-the-hukou-system/.

[26]. “China’s 2024 Local Government Land Sales see 16% Drop in Revenue,” Reuters, January 24, 2025. URL: https://www.reuters.com/world/china/chinas-2024-local-government-land-sales-see-16-drop-revenue-2025-01-24/#:~:text=BEIJING%2C%20Jan%2024%20(Reuters),for%20the%20whole%20of%202023.

[27]. Jean Oi, Jason Luo, and Yunxiao Xu, “A Perfect Storm: Fiscal Discipline COVI, and Local Government Debt in China,” China Journal, Volume 93, February 2024. URL: https://www.journals.uchicago.edu/doi/abs/10.1086/734005?casa_token=n8oqhqR-U5QAAAAA%3AcmycGEm2X4mNPIYfJwQtrf-CH0qeLM7iNf22lbpFfzL8bPqU621Q9NCvGdrQzxu8E-rpmc-au8Y&journalCode=tcj.

[28]. Keith Bradsher, “China’s Government is Short of Money as its Leaders Face Trump,” New York Times, March 21, 2025. URL: https://www.nytimes.com/2025/03/21/business/china-taxes-trump-tariffs.html.

[29]. Logan Wright, Camille Boullenois, Charles Austin Jordan, Endeavour Tian, and Rogan Quinn, “No Quick Fixes: China’s Long-term Consumption Growth,” Rhodium Group, July 18, 2024. URL: https://rhg.com/research/no-quick-fixes-chinas-long-term-consumption-growth/.

[30]. Wei Lingling, “Xi Digs in with Top-Down Economic Plan Even as China Drowns in Debt. Xi Jinping is Bracing for a Showdown, Sticking with Economic Policies Aimed at making China the World’s most Powerful Country,” Wall Street Journal, December 23, 2024. URL: https://www.wsj.com/world/china/china-xi-debt-economic-plan-13aaeec1.

[31]. Rachel Feng, “China Tells Chief Economists: Be Positive,” Wall Street Journal, December 20, 2024. URL: https://www.wsj.com/world/china/china-tells-chief-economists-be-positive-or-else-fbb4dcce.

[32]. Gerard DiPippo, “Focus on the New Economy not the Old: Why China’s Economic Slowdown Underrates Gains,” Rand Corporation, February 18, 2025. URL: https://www.rand.org/pubs/commentary/2025/02/focus-on-the-new-economy-not-the-old-why-chinas-economic.html.

[33]. David Pierson, “This is the Trade Conflict Xi Jinping has been Waiting For,” New York Times, May 10, 2025. URL: https://www.nytimes.com/2025/05/10/world/asia/xi-jinping-china-trade-war.html.

[34]. Nectar Gan and John Liu, “US and China Agree on Plan to Ease Export Controls After Trade Talks in London,” CNN, June 11, 2025. URL: https://www.cnn.com/2025/06/10/business/us-china-trade-talks-london-agreement-intl-hnk.

[35]. Zhou Tianyong, “Zhou Tianyong’s Economic Reform Agenda,” Center for China and Globalization, Pekingnology, May 30, 2025. URL: https://www.pekingnology.com/p/zhou-tianyongs-economic-reform-agenda.